Buying a Spanish Home in 5 Easy Steps

We make it easy for you to see resales, bank repossessions and bargains!

We have access to the largest property portfolios in the Costa Blanca.

Just contact us by email or phone, let us pick the portfolios for your needs and arrange all your appointments!

1. Look for a flight

We just need the date you’d prefer to be met (10am pick-up preferred), address of where you are staying, your mobile number and we'll have someone meet you. A couple of days looking at property should be enough, but why not go for a week’s holiday in Benidorm or a long weekend in Alicante and work it round that? If you are looking in the Costa Blanca check out the cheap flights with www.easyjet.com, www.jet2.com or www.ryanair.com to Alicante or Murcia. Or use SkyScanner to book a flight to Alicante

2. Call us with your dates

Once you’ve called Let’s Live Abroad (0141 25 88 935 or 0844 991 0777) to tell us when you are going out, we can put you in touch with a currency exchange provider who will send you a FREE EURO VISA CARD and put €50 in cash on it! (Ask for more details).

3. Pick a property

We should now know you’re budget and what you’re looking for, so when you’re in Spain we will have someone with keys to pick you up, drive you round and show you some bargains. Don't forget properties are usually on with multi-agencies so let us know if you see a property listed elsewhere and would like to include it in your itenarary. We can select representatives that are not English estate agents but English-speaking Spanish real estate professionals with connections to local banks, realtors and vendors to help find you a bargain. There is NO PRESSURE! And certainly no paid inspection tours that channel you into seeing high commission-yielding properties. We wait for you to tell us if you've seen something you like. If you don’t see anything, don’t worry, you can always come back another time.

4. What does it cost to buy? (Subject to changes)

You can put down a small deposit to hold the property if you fear it could be snapped up by someone else. Otherwise....

As a general rule of thumb: Add 10-14% to any purchase price.

Let's break it down: -

VAT (IVA) is 10% of purchase price.

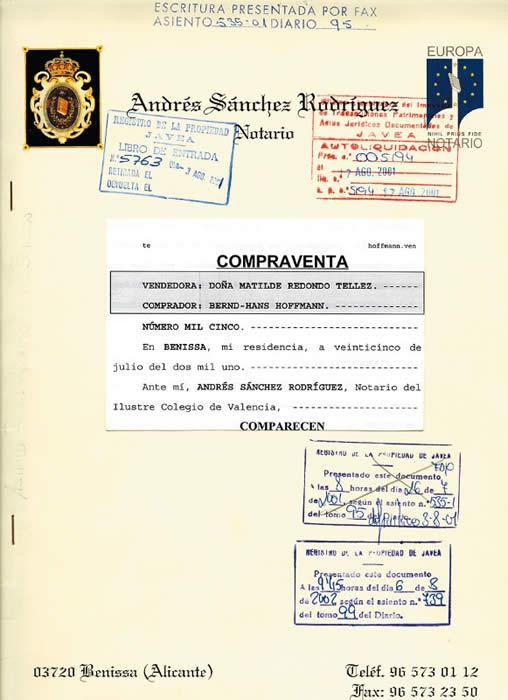

It is wise to add another 3% to cover Land Registry and Notary fees (this fee is set by Government). The Notary is responsible for paying any taxes and registering your property with the Land Registry).

Solicitor’s fees (your solicitor will review the sale agreement, verify title deeds, and carry out other checks to ensure that you're protected).

Water and electricity.

Stamp Duty.

Council Tax (SUMA) in Spain is considerably cheaper than the UK with the annual refuse collection tax paid separately. As a guide, council tax and refuse collection is between approximately €100 and €200 annually for a 2 bedroom apartment.

For properties under €100,000, buying taxes remain low – in fact, they can often cost you less than the effect a swing in the £/€ exchange rate can have on your purchase.

If you require a mortgage, set up fees of banks may vary but it’s normally 1.5% to 2.5% of the mortgage required. You might need to show a copy of your P60 (or three month's wage slips); your last two month's bank account statements; last year's tax return and an Experian credit report. (Your credit report can be obtained free from www.experian.co.uk).

Fuel is slightly cheaper, (approximately 10p a litre) and alcohol is considerable cheaper. A Campo Viejo Rioja in the UK is approximately £6 compared to £2.50 in Spain.

5. Pour yourself a glass of Spanish wine

Because we do the rest. We’ll set up a Spanish bank account for you, get you a Spanish lawyer that speaks English and help you get furniture if you need it.

Come and see why the Daily Record called us "the leading overseas property agency".